Negative Gap Between GDP And GVA Growth Likely To Continue

Negative Gap Between GDP And GVA Growth Likely To Continue

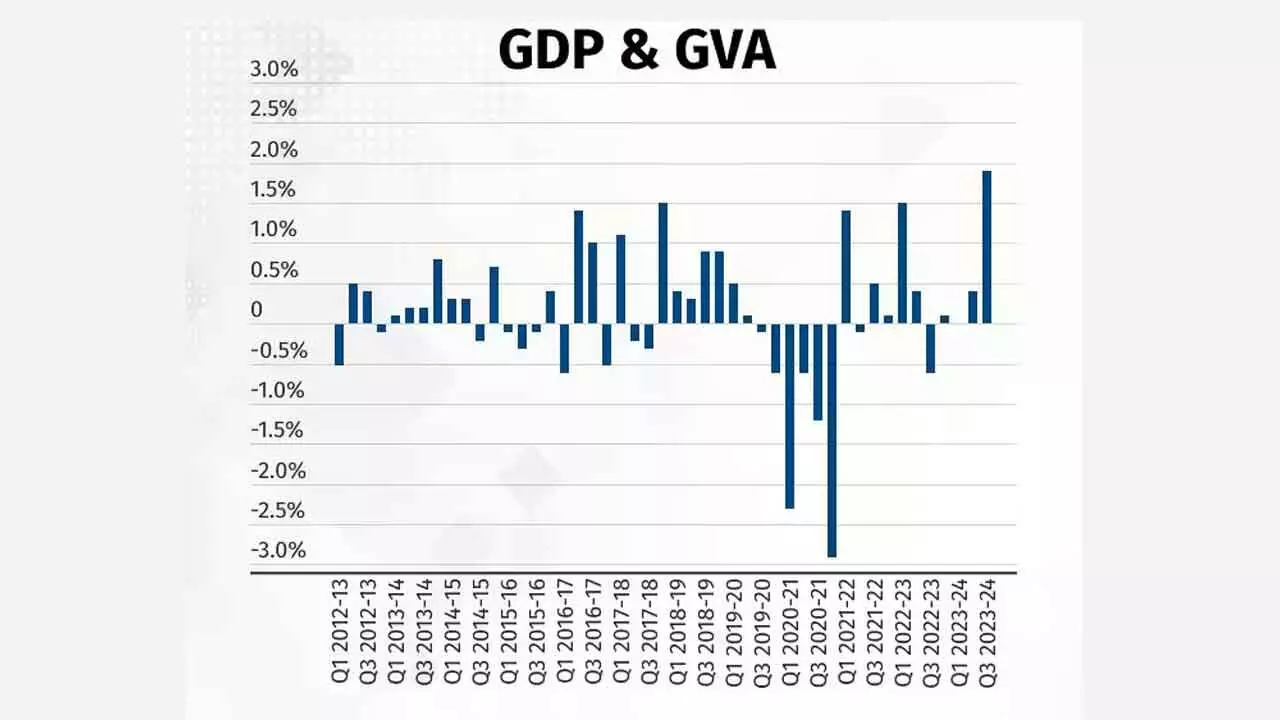

Going by the Q2 GDP numbers, it seems that the gap between GDP and GVA growth, which has remained negative in the past, is likely to continue. The reasons for this is not far to seek. The growth of subsidies is likely to exceed that of indirect taxes. Tepid nominal GDP growth so far implies more than 12 per cent growth is needed in H2 to match budgeted estimate of 10.5 per cent. While H2 will see sequential pick-up in public spending, both on revex and capex, it needs to be seen if general government capex will be able to hit budgeted targets.

Emkay sees urban consumption staying pale ahead owing to weaker incomes, even as it believes that the pick-up in rural consumption is only cyclical. Notwithstanding, the likely sequential improvement ahead, analysts revise down the GDP forecast by 50bps to six per cent, amid slowing manufacturing and a not-too-exciting consumption narrative. A sharp pick-up in public spending since September should increase the contribution of public sector spending in GDP growth for H2.

While government spending has picked up the pace, data for October shows that it is more pronounced for revex, with capex continuing to lag. Additionally, experts are likely to see private consumption remaining tepid – real urban wages have been steadily declining for over 18 months now, and the fall in incomes has hit urban consumption with a lag. The anticipated miss in the capex target is expected to offset any shortfall on account of disinvestment and taxes. There has also been a sharp moderation in investments. The government’s capex that had been supporting growth so far saw moderation with the Centre and consolidated State capex falling by 15 per cent and 11 per cent, respectively, in H1. However, the positive aspect is that consumption growth has remained healthy at around six per cent in Q2. The GDP growth, as per CareEdge, will pick up in the second half of the year as the government pushes up its capex spending.

There are many other reasons to support this argument. Agri production is estimated to be healthy and that should further bolster rural consumption. Food inflation is also expected to moderate by the fourth quarter, which would be supportive of a pick-up in consumption. It should also be noted that urban consumption would be dependent on improvement in the employment scenario and real wage growth. Hence, sustained momentum in consumption growth will be critical for an increase in private investment.

The order book of capital goods companies and road development companies are showing a significant pick up in first half of the year and that bodes well for overall pick up in capex. However, weak growth in China and consequent flooding of markets like India would remain a deterrent when it comes to private investment. On the external front, while merchandise exports growth is likely to remain muted amid global uncertainties, analysts expect the momentum in services exports to continue.